THE GLOBAL ELECTRIC VEHICLE MARKET OVERVIEW IN 2024

- Introduction

- Chapter 1: Historical data on the global EV market

- Chapter 2: Global electric car market share and size

- Chapter 3: The state of other electric vehicles

- Chapter 4: The state of EV charging

- Chapter 5: The development of electric vehicle & charging technology

- Chapter 6: The development of electric car batteries

- Chapter 7: The environmental impact of EVs

- Chapter 8: The current EV-related policies

- Chapter 9: The private sector's response to EVs

- Chapter 10: Forecasts: EV market outlook by 2030 and beyond

Introduction

In this guide, we serve you the latest facts, figures, and forecasts you need to know about the electric vehicle and EV charging market, its predicted growth for 2025 and beyond.

The global electric vehicle market share has taken a tremendous leap forward in the past decade, and we expect the trend to only accelerate in the coming years.

In a number of countries, electric vehicles are on a path to become a mass-market product. Even though there are some concerns arising about the industry’s pace of growth, global sales data are proving that we’ve only just scratched the surface.

Historical EV market data

To understand the current situation of the EV sector, let’s look at what happened in the past couple of years.

The year 2020 did not show a significant growth in overall new car registrations. The global market for all types of cars was negatively affected by the COVID-19 pandemic and the economic downturn that followed. Amid the pandemic, the outlook for global EV sales was quite unpredictable at the beginning of the year.

However, as time showed, 2020 turned out to be a surprisingly positive year, with global EV sales growing by 43% from 2019 and the global electric car industry market share rising to a record 4,6%.

The year 2021 was a major leap forward for electric vehicle sales as they doubled from 2020 to 6.75 million. The number of EVs sold in a week in 2021 was higher than how many were sold in the whole year of 2012.

The year 2022 came on strong, breaking records. EV sales exceeded 10 million, with 14% of all new cars sold being electric, quite the jump from 9% in 2021 and less than 5% in 2020. That resulted in more than 26 million electric cars roaming global roads in 2022, representing a 60% uptake from 2021.

Global electric car market share and size

EVs are to play a central role in the ambitious objective of zero-emission targets set for 2050, and the industry is gearing up for it.

The market is growing. It’s growing fast. And it’s growing everywhere.

Carried by a decarbonisation challenge most leading nations now take seriously and supported by various policies and incentives, global EV sales kept accelerating in 2023. According to the IEA, the global electric car sales reached almost 14 million, which represented a 35% increase from 2022. This growth meant that the global electric fleet rose to 40 million in 2023.

Source: Global EV Outlook 2024

And the trend seems to stay positive in 2024. Only in the first quarter of the year, sales grew by 25% compared to the same period in 2023.

We're predicted to see 17 million in sales by the end of 2024. Electric cars could account for 20% of total car sales by then. The IEA sees a great growth potential, especially outside of the core markets of China, Europe and the USA. That is a good sign that e-mobility is finding its way to the rest of the world.

Source: EV volumes

China, Europe and the USA are the largest markets for electric vehicles and together account for around 95% of all sales in 2023.

Source: Global EV Outlook 2024

Regarding the availability of EV models, there was a total of 590 electric car models available for consumers in 2023. This is an increase of 15% compared to the previous year. It’s predicted that 1 000 models should be available in 2028.

How's the situation in Europe?

After experiencing a downturn in EV sales in 2022, Europe accounted for 25% of global electric car sales in 2023 and is projected to keep that up in 2024, remaining the 2nd largest market for electric vehicles after China. Electric car sales were more than 20% higher in 2023 compared to 2022 and reached almost 3.2 million. In the EU, that number was around 2.4 million.

The continent’s EV sales continue to increase steadily in most countries, except Germany, where the sales share fell from 30% to 25% mainly due to the phase out of several purchase subsidies.

The otherwise increasing figures reflect the implementation of stricter rules regarding CO2 emission standards, such as the mandated 100% reduction in CO2 emissions for new cars and vans from 2035, but also various stimulus measures introduced by many European governments and tax benefits and subsidies put in place in major markets.

Norway (95% of all cars sold are electric), Sweden (60%) and the Netherlands (30%) remain to be the largest European markets, according to the 2024 Global EV Outlook by IEA. France and the United Kingdom come in right after with 25% of all cars sold being electric.

Read also:

The state of global EV charging infrastructure

Most charging still happens at home or work, with the number of private chargers being ten times higher than that of public ones. In the United Kingdom, we can find one of the highest shares of home charging access, 97%.

But the more electric vehicles roaming the roads, the more public charging points are needed to support the wide EV uptake, especially in more dense areas where access to home charging is more limited.

In 2023, the public charging stock rose by around 40%. Fast chargers, specifically, accounted for 35% of the public charging stock by the end of the year and outpaced the growth of slow chargers.

For both slow AC charging and fast DC charging, China dominated the market in 2023. Over 85% of world’s fast chargers and 60% of slow chargers were installed in China over the year.

And how about Europe?

In 2023, over 630 000 publicly available EV chargers were counted in Europe. Almost 200 000 new charge points were added over the year, according to the European Alternative Fuels Observatory (EAFO). 155 000 were standard charging stations and 40 000 fast charging stations. By 2030, it's estimated that 3.5 million charging stations will be publicly accessible across the continent.

It seems that most European countries already met their public charging infrastructure targets for 2024. The Netherlands takes the lead with a total of 160 000 charging stations, closely followed by Germany (133 000), France (128 000) and Belgium (59 000). The Netherlands, France and Germany together account for 61% of all public charge points in the region.

Source: ACEA

Governmental support for public charging infrastructures

With several EV purchase subsidies working their charm in numerous countries in the past few years, governments are now shifting their focus on expanding support for EV charge points. This comes in the form of subsidies and incentives as well as developing legislation and regulations relating to payments, reliability and interoperability of public charging infrastructures in order to improve EV driver experiences.

The European Union developed the Alternative Fuels Infrastructure Regulation (AFIR), which requires, among other things, the installation of fast charge point ever 60 km along the Trans-European Transport Network (TEN-T). In the UK, the Public Charge Point Regulations focus on improving the customer experience at public charge points.

The need to develop sufficient public charging infrastructures spans across developing markets, too. For example, in India, the provided funding made it possible for 7 000 fast chargers to be installed in the country in 2023.

Charging for heavy-duty electric vehicles (HDEV)

Heavy-duty vehicles can generally charge at the same charge points as light-duty vehicles, but the bigger the size of the battery, the longer the charging time. Charging heavy-duty vehicles can thus result in distruptions and delays at regular charging facilities. Dedicated charging spaces for heavy-duty vehicles are more than needed, but their development is still in its infancy.

To prepare for the wave of HDEVs, there’s a strong need for a network of ultra-fast (HPC) chargers and a new charging standard that further lowers the charging times. Luckily, both are in the works.

The AFIR states that heavy-duty electric vehicles must be able to charge with a minimum output of 350 kW every 60 kilometres along the core TEN-T network and every 100 kilometres along the larger TEN-T network.

A new charging standard, the megawatt charging standard (MCS), which allows charging capacity up to 3.75 MW has been in development since 2019. The standard is now being tested by the CharIN association, which is responsible for developing the system, and should become the industry standard for heavy-duty charging by 2025.

The state of other electric vehicles

While passenger cars typically get all the credit for the EV revolution, it’s good also to consider other forms of transportation that are gradually becoming greener.

From public transportation to e-scooters: The entire transportation industry is turning electric

Heavy-duty trucks

In 2023, electric trucks surpassed electric buses in sales for the first time, at 54 000, growing by 35% from 2022. As many truck manufacturers strive for an all-electric future, the number of commercially available zero-emission truck models has been expanding. The market offers over 840 models by more than 100 OEMs, with European manufacturers offering the largest model selection.

Europe reached more than 1,5% of sales share, increasing sales share almost threefold and reaching more than 10 000 electric trucks. And the expectation is for this number to further grow, also thanks to various ambitious policies. One of them being the European Union’s target to reduce CO2 emissions from HDVs by 90% by 2040.

The electrification of the heavy-duty sector is a crucial part of the journey to a zero-emission future because even though heavy-duty trucks only account for 10% of all ICE vehicles, they are responsible for 70% of ICE CO2 emissions.

Light commercial vehicles (LCV)

Electric LCVs saw considerable growth in 2023 as sales grew by over 50%. The two biggest markets for electric LCVs were China, where sales exceeded 240 000 and in Europe, where 60% growth brought the number to 150 000.

One out of twenty-five LCVs sold in 2023 was electric. As more electric LCV models enter the market and commercial customers become aware of the ‘reduced cost’ benefit of electric LCVs, we expect the market to only accelerate in the future.

Electric buses

Electric buses have been growing in popularity since 2020. In 2023, almost 50 000 electric buses were sold globally, which brings the global stock to over 635 000. China used to dominate the market; in 2020, it was responsible for over 90% of electric bus sales, but in 2023, the Chinese demand dropped. This could be due to its already large electric bus stock and the end of purchase subsidies. The country still remains a major exporter to Latin American, North American and European countries.

In the European Union countries, the Clean Vehicles Directive provides targets for public procurement of electric buses. France, Germany, and Spain are only a few EU countries witnessing increased electric bus sales. Belgium, Norway and Switzerland achieved over 50% of sales share in 2023.

Two and three-wheelers

Electric two and three-wheelers accounted for 13% of total sales in 2023 making it the most electrified vehicle segment globally.

Historically, China dominated the electric two-wheeler market, but in 2023, the sales dropped by a quarter. This drop wasn't unique to China as the sales dropped globally by 18%. This decline was mainly caused by supply bottlenecks following the Covid-19 pandemic.

In terms of electric three-wheelers, sales grew by 30% compared to 2022. China and India together account for nearly 95% of global sales.

Used electric cars

With increasing EV sales figures, used vehicles are becoming increasingly available and more affordable.

In 2023, the market for used electric vehicles included about 800,000 vehicles in China, 400,000 in the United States and over 450,000 in France, Germany, Italy, Spain, the Netherlands and the United Kingdom.

The prices of used electric cars are falling rapidly and are becoming increasingly competitive compared to conventional combustion engines.

The used car market for electric vehicles plays a decisive role in promoting electric mobility to the masses.

Similar to internal combustion engines, where the purchase of a used car is often the preferred method of buying in emerging and industrialised countries, we can expect a similar pattern to form for electric vehicles.

In the EU, eight out of ten people buy their cars used. Since the market for electric vehicles is now mature, the availability of used cars is also increasing.

The development of electric vehicle and charging technology

Smart charging

Smart charging of electric vehicles, i.e. the use of cloud-connected charging devices is already somewhat of a standard in the industry. For business owners and consumers alike, smart EV charging allows — among other things— greater convenience and control over electricity consumption.

Vehicle-to-Grid

Vehicle-to-grid (V2G) technology makes it possible to transfer the electricity stored in electric vehicle batteries back to the grid in the same way stationary storages are connected to the grid. V2G services are already commercially available, and several charger manufacturers can supply V2G chargers.

The V2G market is projected to grow to over €5 billion by 2024. The European standard for V2G charging, ISO 15118-20, developed back in 2020, defines the requirements for bidirectional charging. According to Bain & Company's forecasts, solutions for energy management will also account for around three thirds of the revenues from the charging business by 2030.

Virta has been recognised as one of the global leaders in V2G technology.

Plug&Charge

Plug and Charge is a technology that greatly simplifies the charging process, enabling EV drivers to identify themselves safely and easily at the charging station by, as its name suggests, simply plugging in.

Meaning and functionality

Plug and Charge is based on the ISO 15118 standard, an international communication protocol for bi-directional communication between electric vehicles and charging stations.

This protocol enables secure authentication of the vehicle directly via the charging cable. As soon as the vehicle is connected, the authentication data is automatically transferred and the charging process begins without the necessary manual steps.

Importance for the EV charging industry

Plug and Charge offers numerous advantages for the EV charging industry:

- Ease of use: By eliminating the need for charging cards or apps, the charging process is simplified and more comfortable for EV drivers.

- Security: The technology uses encrypted communication, increasing the security of transactions.

- Efficiency: Faster and seamless charging processes lead to higher customer satisfaction and more efficient use of the charging infrastructure.

- Compatibility and standardisation: The introduction of Plug&Charge promotes standardisation within the charging infrastructure and facilitates the integration of new vehicles and charging stations.

The development of electric car batteries

The increase in electric car registrations resulted in an increased production of automotive lithium-ion batteries. In 2023, EV battery demand increased by 40% from the previous year as EV sales continued to grow in all markets, especially in Europe and the US.

The battery demand increase can be attributed to the growing sales of battery electric vehicles (BEV) and plug-in hybrid electric vehicles (PHEV), which require batteries larger in size as opposed to hybrid electric vehicles (HEV).

China remains the leading country for battery production, specifically heavy-duty battery production. About 12% of batteries produced in the country are exported. However, Europe is not staying behind. According to BloombergNEF, Europe’s share of global battery production could rise to 31% by 2030.

China's role in battery production

China continues to take the leading role in the upstream stages of the value chain. China accounts for almost 90% of the worldwide installed production capacities for active cathode materials and over 97% of the production capacities for active anode materials.

The only countries with significant shares in the production capacity for active cathode materials outside China are Korea (9%) and Japan (3%).

China's dominant position in battery production has led to an overproduction of batteries and makes the country the world's largest exporter of battery cells, cathodes and anodes worldwide.

At the same time, this puts some manufacturers under pressure, as production capacities in Europe and the USA increased by 25% compared to the previous year, respectively.

The IEA predicts that battery production will continue to focus around the largest centers of EV production until 2030.

Battery prices witness a drop

2023 was the year when prices of EV batteries dropped. This was largely caused by prices of all major battery metals, like cobalt, graphite and manganese dropping. This caused an almost 14% price decrease of finished batteries compared to 2022.

Battery production remains the cheapest in China, followed by North America and Europe.

Improvements to be expected

The market is expecting improvements in battery systems through battery pack reconfigurations, such as cell-to-pack1 and cell-to-chassis2. Innovation can also be expected in manufacturing to achieve improved battery performance. An example of this can be multi-layer electrodes which enable ultra-fast charging.

Battery recycling necessary

A common worry about electric car batteries is the difficulty of ensuring their sustainability. That’s where recycling and reuse must come into place. Global battery recycling capacity reached 300 GWh in 2023. By 2030, this number could grow to 1 500 GWh. The battery recycling industry is surely getting ready for the growth of EV battery retirement.

1Battery packs used in EVs are typically made of a series of modules, each containing several battery cells. In the cell-to-pack configuration, battery cells are assembled to build a pack without using modules, which reduces the need for inert materials and increases energy density. (Global EV Outlook 2024)

2In cell-to-chassis concepts, battery cells are used as part of the EV structure without being assembled into a battery pack beforehand. (Global EV Outlook 2024)

The environmental impact of EVs

Altogether EVs consumed approximately 130 terawatt-hours of electricity in 2023. This corresponds to Norway’s total 2023 electricity consumption. EVs are projected to account for around 6-8% of global electricity consumption by 2035.

As the electricity demand for charging electric vehicles grows, the need to protect the electricity grid grows with it. Careful planning of electricity infrastructure, the widespread use of smart charging and the implementation of smart energy management solutions for load management will all be crucial to ensure healthy and balanced power systems.

EVs as battery storages

EVs have the potential to become the saving grace of energy utilities in the future. By the 2040s, electric vehicles will add up to over 30 TWh of installed battery storage capacity. For utilities, this means that EVs offer cheap energy storage, with no capital cost and relatively low operating costs.

This becomes especially interesting with the growth of renewable energies as their production tends to fluctuate. This technology is called Vehicle-To-Grid and enables energy to be pushed back to the power grid from the battery of an electric vehicle.

Emission savings

In 2023, EV use saved more than 220 million tonnes of GHG emissions EVs globally, compared to 80 million in 2022. In practice, EV emissions are mainly born due to the manufacturing process, while we can’t apply similar logic to internal combustion engine (ICE) cars. A battery electric vehicle sold in 2023 will only produce half the amount of emissions an internal combustine engine vehicle would over its lifecycle.

In the grand scheme of things, it’s safe to conclude that the public debate over EVs vs ICE cars’ environmental impact is turning in favour of EVs.

Future predictions based on the Stated Policies Scenario say that by 2035, using EVs could help avoid 2 Gt of carbon dioxide equivalent (CO2-eq) of GHG emissions.

The consequences of the SUV trend

SUVs produce higher amount of emissions during production, approximately 70% higher than with smaller EVs. In addition, SUVs need larger batteries, putting higher demand on rare minerals and other resources.

If all electric SUVs sold in 2023 would have been medium-sized vehicles, around 60 GWh of battery equivalent could have been saved globally, according to IEA.

Read also:

The current EV-related policies

It’s no secret that governmental and local policies play a huge role in accelerating EV adoption.

Major markets (China, the US, Europe) that are currently seeing rapidly growing EV sales began their EV journeys by introducing policies like vehicle purchase incentives. These markets are now shifting from incentivising the sales of electric cars towards supporting heavy-duty transportation and roll-out of EV charging infrastructure.

Example: The United Kingdom

The country stopped subsidising the sales of electric cars and dedicated GBP 1.6 billion to growing the public charging infrastructure. In 2023, 53 600 chargers were installed in the country. It's expected that 300 000 public chargers will be installed in the country by 2030.

On the other hand, in emerging economies with large car markets, subsidies and incentives for electric cars still play a key role in further growth.

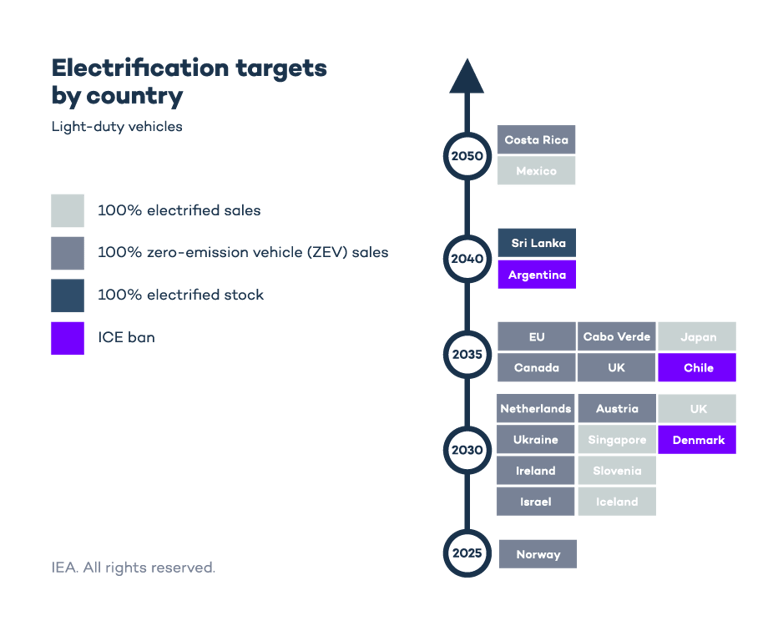

EV-related policies are crucial in driving countries towards their electrification targets. While some countries strive for 100% electrified sales, others plan to ban the sales of ICE vehicles completely. Let's take a closer look at the varying electrification targets of countries globally and their timeline.

Source: Global EV Outlook 2023

Source: Global EV Outlook 2023

In addition to purchase incentives and subsidy programmes, governments are also instituting various policies targeting the EV charging infrastructure, its accessibility and EV charging payments. These policies are meant to ensure seamless charging experiences for EV drivers and help EV adoption.

The private sector's response to EVs

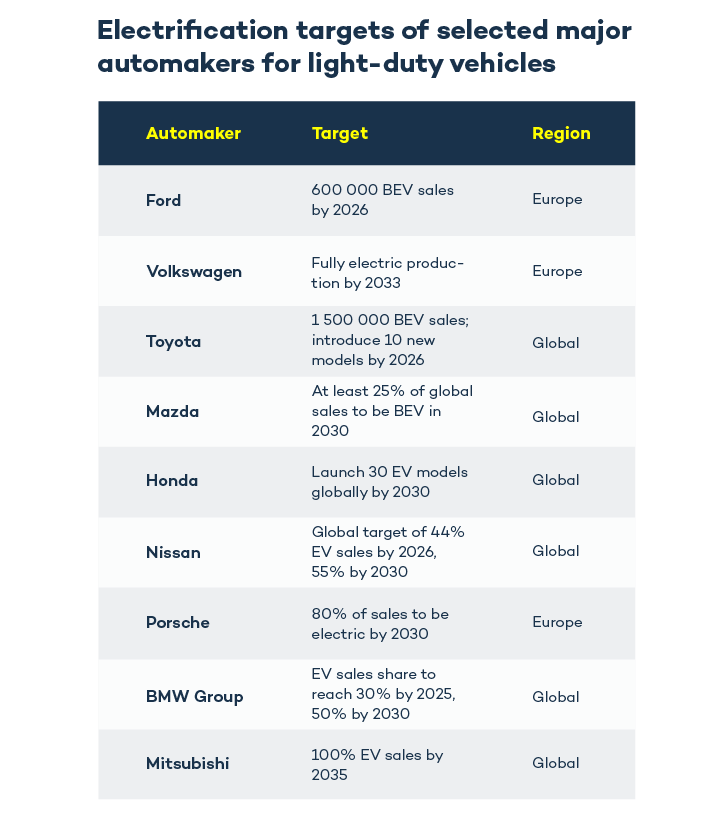

The private sector, and car manufacturers, in particular, have responded positively to the ongoing changes in the market. Many car manufacturers have announced electrification of their fleets either partially or fully.

Let's look at some of the major automakers' electrification targets.

Source: Global EV Outlook 2023

Source: Global EV Outlook 2023

On the fleet side, EV100, a global initiative supporting the switch to zero-emission transportation with its 130 members, is committed to switching to electric and installing charging infrastructure for employees and customers by 2030.

To list a few examples, Unilever pledges to transition its fleet of more than 11 000 vehicles to electric and install workplace EV charging for their staff. ABB also plans to switch to electric for their 11 000 fleet vehicles.

But it's not only the companies that are part of EV100 introducing ambitious pledges. DHL has pledged to reach 70% clean operations of last-mile pick-ups and deliveries by 2025. And DB Schenker wants to make its transport activities in European cities emission-free by 2030.

While actions like these are worthy of attention on their own, their fringe benefit is that they act as signalling devices for the rest of the market. In other words, public pledges like these pressure competitors and stakeholders to act faster than they otherwise would have.

Forecasts: EV market outlook by 2030 and beyond

When it comes to the future, according to the Global EV Outlook 2024, there are three possible scenarios:

1. The Stated Policies Scenario (STEPS)

This scenario reflects existing policies and measures implemented by governments worldwide.

It suggests that by 2030, the global electric vehicle stock (excluding two/three-wheelers) will reach nearly 250 million vehicles and grows to 525 million in 2035, when one in four vehicles on the road would be electric. Sales share could reach over 50% in 2035.

2. The Announced Pledges Scenario (APS)

This scenario assumes that all announced targets are fully met on time.

That makes the scenario bit more ambitious. According to APS, almost 585 million EVs will be roaming global roads by 2035, representing around 66% of sales share.

3. The Net Zero Emissions by 2050 Scenario (NZE)

The NZE scenario assumes that Net Zero emissions will be achieved by 2050 and that global temperature increase can be limited to 1.5 C.

NZE predicts that the global EV stock will have to reach 790 million EVs in 2035, with EV sales climbing up to 95% of all vehicle sales in 2035 if we want to achieve Net Zero by 2050.

What about Europe?

The next few years will be crucial for Europe to secure its leading status. We expect to reach a first milestone of 14 million EVs by 2025. After that, low estimates mention EV sales share to reach 85% in 2035, while high estimates talk about 95%.

From 2035 onwards, we expect 100 % of new cars sold in Europe to be electric.

Of course, only time (and new data) will tell us if those predictions are to become realities. However, the latest trends are heading in the right direction.

In other words, the time businesses embark on the EV train is now!

From our blog

Stay up to date with what is new in our industry, learn more about the upcoming products and events.

/man-standing-beside-ev-and-v2g-ev-charger.webp?width=1920&height=1080&name=man-standing-beside-ev-and-v2g-ev-charger.webp)

How will the EU-Automotive Act affect Vehicle-to-X (V2X) market development?

/electric-vehicle-tail-lights-glowing-trails-night.webp?width=1920&height=1080&name=electric-vehicle-tail-lights-glowing-trails-night.webp)